Buying a home, remortgaging, or investing in residential property can be one of the most important economic choices you'll ever make. That's why having actually a relied on expert on your side is critical. Whether you're a newbie buyer, relocating home, seeking to remortgage, or thinking about buy-to-let opportunities, a regional Mortgage Broker Merseyside can help lead you with every action of the process.

In this post, we'll break down the worth of using a mortgage broker, describe how the procedure functions, and highlight why selecting a Mortgage Broker Liverpool, Mortgage Broker Crosby, Mortgage Broker Ormskirk, Mortgage Broker Preston, Mortgage Broker Southport, or Mortgage Broker West Lancs could make all the distinction in your financial journey.

Why Use a Mortgage Broker?

A home mortgage broker functions as an intermediary between you and possible lenders. As opposed to going straight to a bank or building society, a broker searches throughout multiple loan providers to locate the best offer customized to your needs. This saves you time, possibly conserves you money, and ensures you get experienced guidance throughout the procedure.

Some vital advantages of using a local broker:

Access to special bargains not available to the public

Professional understanding of the Merseyside and North West property markets

Support with documents and application procedures

Suggestions customized to your economic situation and goals

Assistance with remortgaging, buy-to-let, and much more

Whether you're in the heart of Liverpool or the quieter areas of West Lancashire, a regional broker can use unequaled understanding and customised solution.

Mortgage Broker Liverpool-- City-Centric Expertise

The Liverpool real estate market is among the most dynamic in the UK. From contemporary apartment or condos by the waterside to historic terraced homes, the city provides something for each type of buyer.

A Mortgage Broker Liverpool understands the busy nature of the city's real estate need. They can assist novice buyers find economical starter homes, recommend investors on rental hotspots, and aid family members upgrading to larger residential or commercial properties. Their familiarity with local lending institutions, building values, and legal factors to consider is a significant advantage when navigating the marketplace.

For those thinking about Liverpool remortgages, a broker can evaluate whether changing loan providers or renegotiating your current offer could conserve you money.

Mortgage Broker Ormskirk-- Suburban Insight

Simply 13 miles north of Liverpool, Ormskirk is a stunning market community using a quieter lifestyle with superb transport web links. A Mortgage Broker Ormskirk knows the neighborhood nuances of acquiring in a smaller, dense area and can use targeted advice on appropriate home mortgage products for country or suburban buildings.

Whether you're purchasing a duration home near the town centre or a new-build on the edge of town, an Ormskirk-based broker can assist you secure competitive prices with adaptable terms.

Mortgage Broker Crosby-- Coastal Confidence

The seaside town of Crosby is understood for its magnificent coastline, exceptional colleges, and close proximity to Liverpool. Whether you're moving for job, updating your home, or investing in a family-friendly neighbourhood, a Mortgage Broker Crosby uses neighborhood knowledge that's hard to beat.

With increasing passion in seaside residential or commercial properties and buy-to-let chances near visitor destinations, a Crosby broker can help you make a financially sound decision that satisfies your long-lasting objectives.

Mortgage Broker Preston-- Strategic North West Knowledge

Heading inland, Preston uses an enticing mix of price, area, and development possibility. With growths in both residential and commercial sectors, the city is increasingly drawing passion from capitalists and homeowners alike.

A Mortgage Broker Preston can aid you browse the wide loaning choices offered while capitalizing on neighborhood possibilities and rewards. Whether you're purchasing your first home, adding to your financial investment profile, or thinking about a Preston remortgage, a regional broker can make the process smoother and extra effective.

Mortgage Broker Southport-- Classic Elegance and Investment Potential

Understood for its Victorian architecture, classy boardwalks, and strong tourist sector, Southport is a prime location for both residential and investment homes. A Mortgage Broker Southport understands the equilibrium between timeless homes and contemporary facilities, along with the seasonal nuances of the residential or commercial property market.

With deep origins in the area, Southport brokers can suggest on whatever from vacation let home mortgages to buy-to-let, shared possession schemes, and new purchaser assistance.

Mortgage Broker West Lancs-- Regional Reach and Rural Property Guidance

The Mortgage Broker West Lancs network covers a diverse series of towns and villages in West Lancashire. Whether you're acquiring a farmhouse in the countryside or a townhouse in Skelmersdale, neighborhood brokers understand the local property landscape and loaning requirements.

They provide hands-on assistance for unique residential properties, agricultural land purchases, and custom-made home mortgage needs that national companies could not fully comprehend.

Liverpool Remortgages-- When and Why to Reevaluate Your Mortgage

If you're currently a home owner in Liverpool or Merseyside, now might be the time to take into consideration Liverpool remortgages. With rates of interest varying and home values altering, a remortgage can aid you:

Lower your monthly payments

Change from a variable to a fixed-rate offer

Borrow extra funds for home enhancements

Settle financial debts right into a solitary settlement

Launch equity for individual objectives or financial investments

A relied on home loan broker can examine your existing home mortgage and supply alternatives customized to your requirements-- commonly discovering offers you wouldn't uncover on your own.

What to Expect When Working with a Mortgage Broker

Choosing the appropriate Mortgage Broker Merseyside or in bordering locations is crucial to getting a personalised, efficient, and hassle-free home mortgage experience. Below's what you can expect:

Initial Consultation

You'll discuss your objectives, budget plan, earnings, and residential or commercial property details.

Home mortgage Search

The broker will certainly search through dozens (or hundreds) of home mortgage products to find ideal choices.

Application Support

They'll deal with documentation, communicate with loan providers, and overview you with approval.

Recurring Communication

Throughout the process, your broker will certainly keep you informed, respond to questions, and see to it you're comfortable every action of the method.

Post-Mortgage Mortgage Broker Preston Advice

Even after your home loan is approved, several brokers provide yearly evaluations to guarantee you're still on the very best bargain.

Final Thoughts: Trust a Local Mortgage Broker in Merseyside

Whether you're acquiring your very first home in Liverpool, updating in Southport, or remortgaging in West Lancs, having a well-informed home mortgage consultant in your corner is important. A relied on Mortgage Broker Merseyside provides not simply accessibility to good deals-- however peace of mind.

With many locations covered-- from Mortgage Broker Liverpool to Mortgage Broker Crosby, Ormskirk, Preston, and beyond-- you're certain to locate an expert who recognizes your needs and is dedicated to aiding you achieve your monetary and homeownership objectives.

Martland Mortgages.com Ltd

Westminster Chambers, 106 Lord St, Southport PR8 1LF, United Kingdom

170-480-8286

Bug Hall Then & Now!

Bug Hall Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Christina Ricci Then & Now!

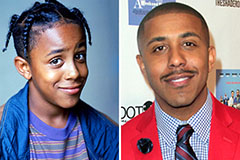

Christina Ricci Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!